Video Game Insights 2021 Market Report

Jan 23, 2022The last 2 years of the games market have been dominated by Covid. However, different types of games studios have seen contrasting effects. As a whole, the industry has seen a boom, but these gains haven’t impacted all games equally.

This report summarises PC games trends from 2017-21. It is using public data from Steam API as well as proprietary data gathered by Video Game Insights. Occasionally, references are made to other reports summarising 2021 games landscape.

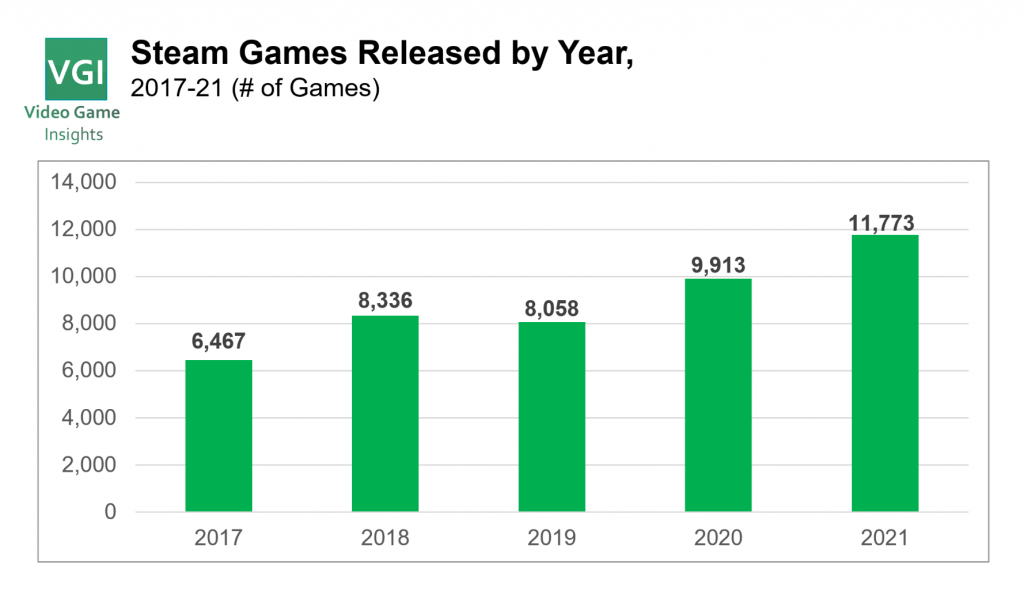

2021 saw the most games ever to be released

There were 11.7k games released on Steam in 2021, beating the 2020 record of c. 10k. That means there are c. 30 games released on Steam every day.

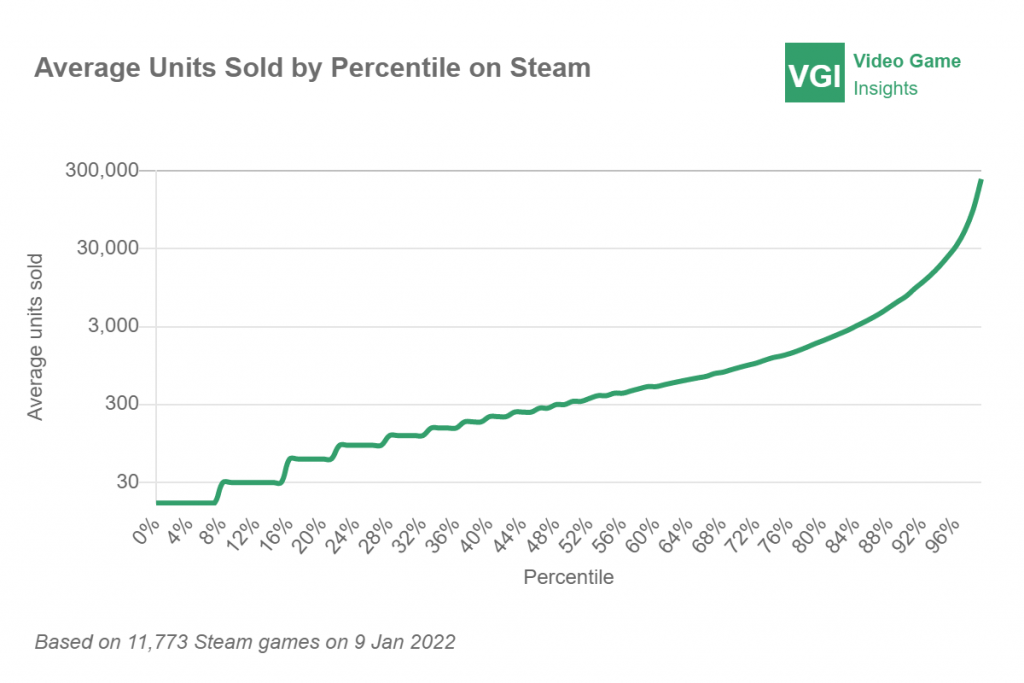

Despite the large number of releases, the majority of games released on Steam are small – mostly hobby projects and shovelware (low quality games with very short development times).

27% of the games released in 2021 have only sold under 100 units. Only about 8% of the games released sold 10,000 units or more.

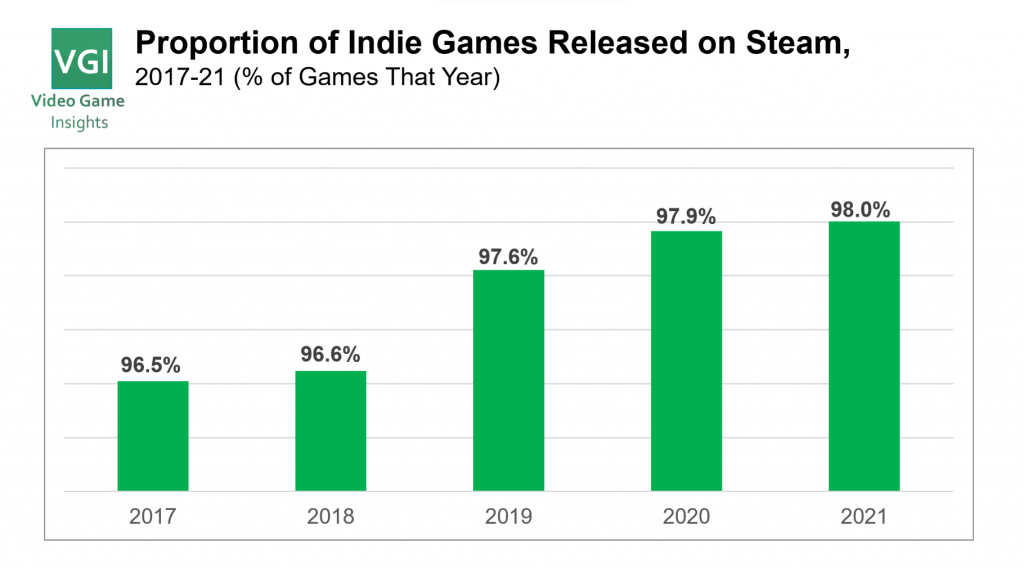

Over 95% of games on Steam are indie games and the proportion is increasing

There are only c. 200 AA or AAA games released on Steam every year. The rest are games released by independent studios – typically by small teams of 1-3 developers.

The proportion of independent games on Steam has increased over time. In 2021, 98% of games released on Steam were indie games.

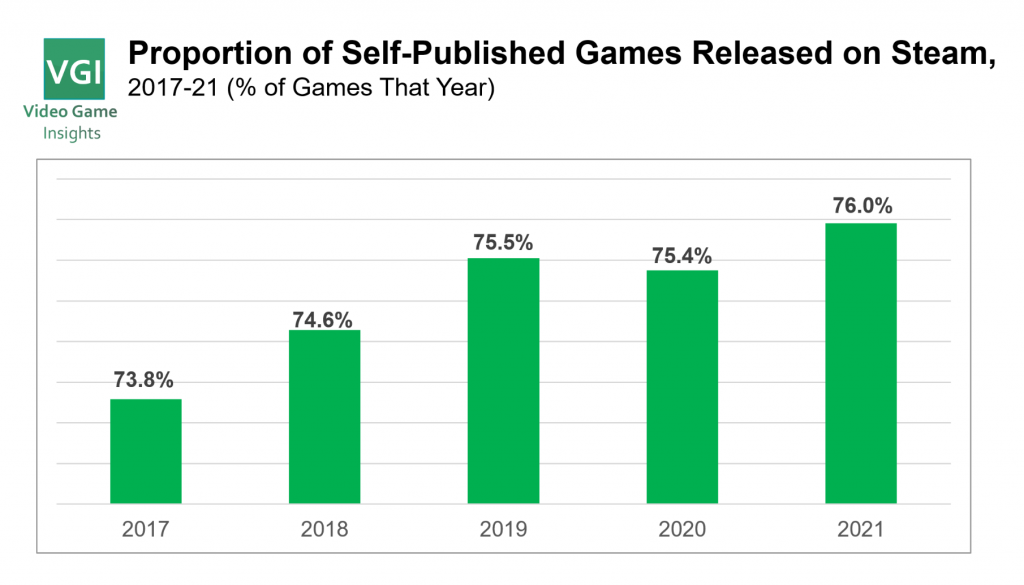

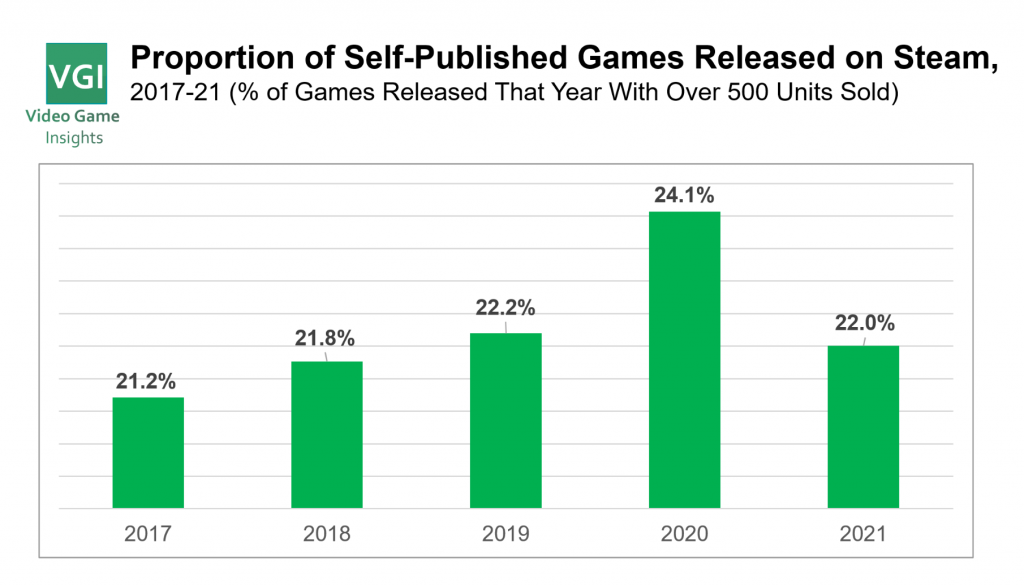

The same trend is true when looking at self-publishing. The proportion of games on steam published by 3rd party publishing companies has consistently declined from 26.2% in 2017 to 24% in 2021.

However, this trend does not hold when filtering out the smallest games. When looking at only games that have sold over 500 units, the vast majority are published by a third party and that ratio has not changed.

The more successful games are still mostly published by third party publishers with appropriate skills and resources to support the developers.

Indie studios and AAA studios went through a very different Covid period

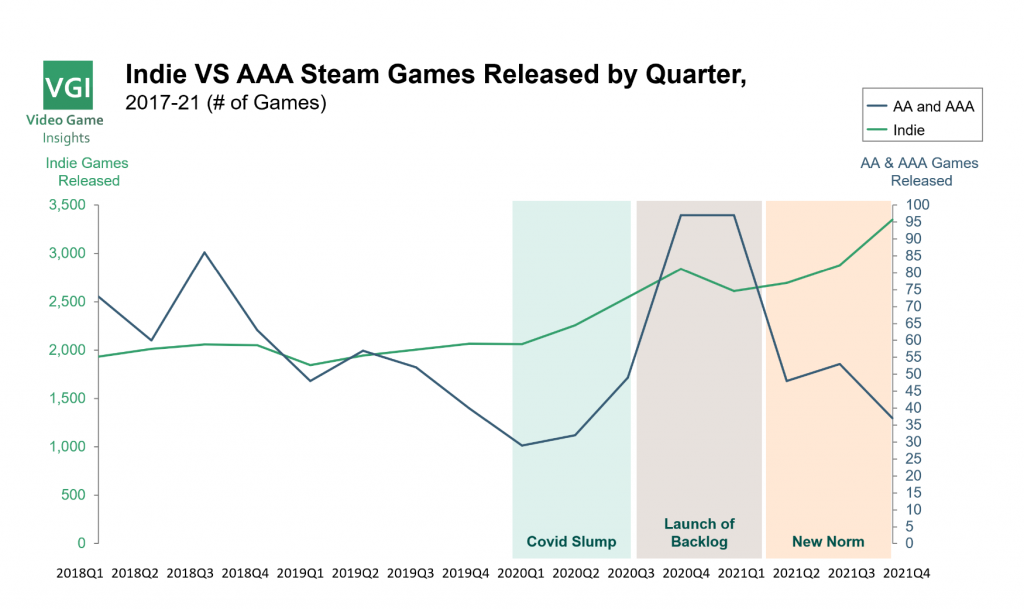

Looking at games released on Steam by quarter, AAA and indie games tell a very different story.

For AA and AAA studios, working from home was hard to adapt to. These organistaions benefitted from office collaboration and increased productivity. Working from home as well as people catching Covid meant games faced delays.

See our methodology and definitions page to understand how we’ve categorised AAA vs AA vs indie.

The different paths are evident in the data – 2020 Q1-Q3 saw a large decline in games released by large studios. Large studios released 40-60 games per quarter pre covid and that declined to 20-30 initially, almost halving.

These delays meant that 2020 Q4 and 2021 Q1 actually saw a huge amount of high budget games released. Cyberpunk is a good example here.

Since 2021 Q1, the AA and AAA releases have stabilised. c. 40-50 games get released every quarter, closer to pre-Covid levels.

It’s worth noting that even though 2021 saw a fair amount of large studio releases, these were mostly smaller titles for the large studios. A lot of the highly anticipated large title releases are planned for 2022.

Indie games, on the other hand, have benefitted hugely from Covid. More working from home means more time for people to devote to their hobby projects. Smaller teams are also nimbler and better adapted to remote work. Many of them were remote to start with.

Since Covid, the number of Indie game releases has only grown. Pre-covid, c. 2,000 indie games were released every quarter. By the end of 2020, it had grown to 2,800. Q4 of 2021, however, saw 3,350 games released – 68% more than pre-Covid!

You can use the Video Game Insights free Steam Analytics tool to see more release trends.

Free games were popular during the start of the pandemic, but have lost popularity in 2021

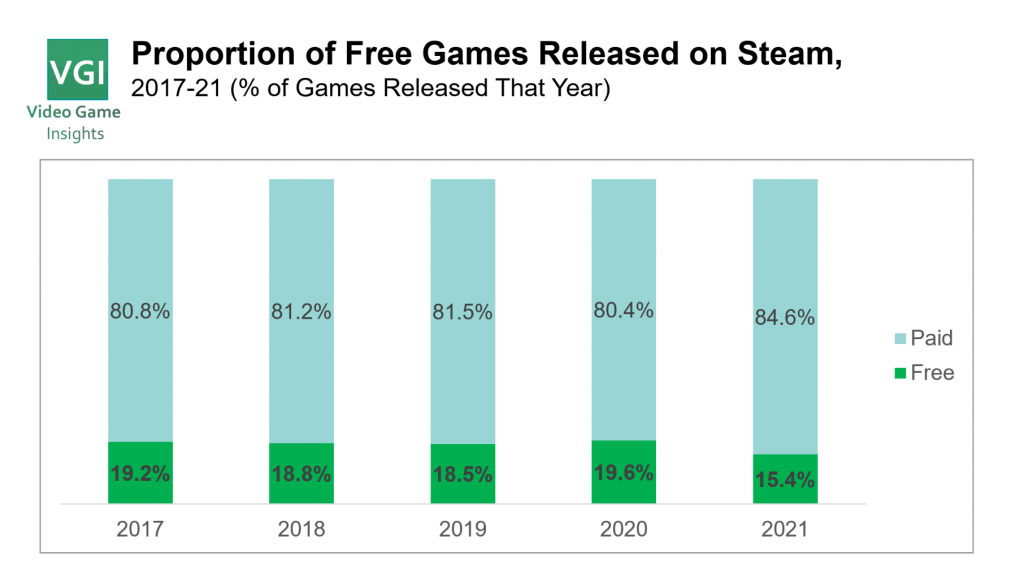

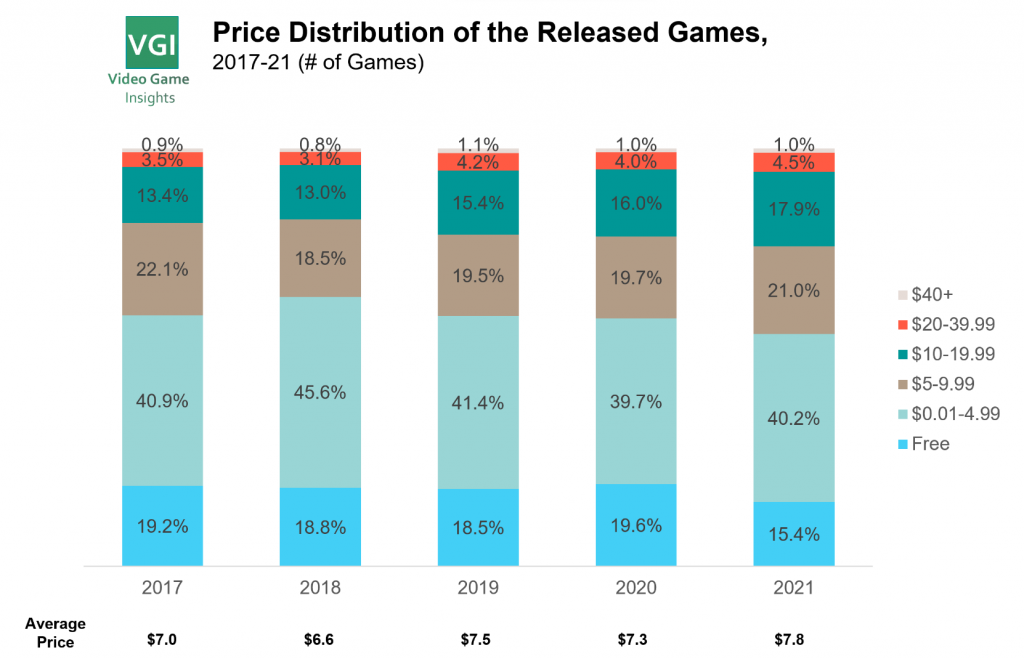

Close to 20% of the games on Steam have always been free to play. However, this trend has been declining.

Covid boosted the proportion of free games on Steam temporarily. This could have been driven more by premium game releases being delayed into 2021. It fits the 2021 data where only 15% of the games released on Steam were free – lowest it’s been for the last 5 years.

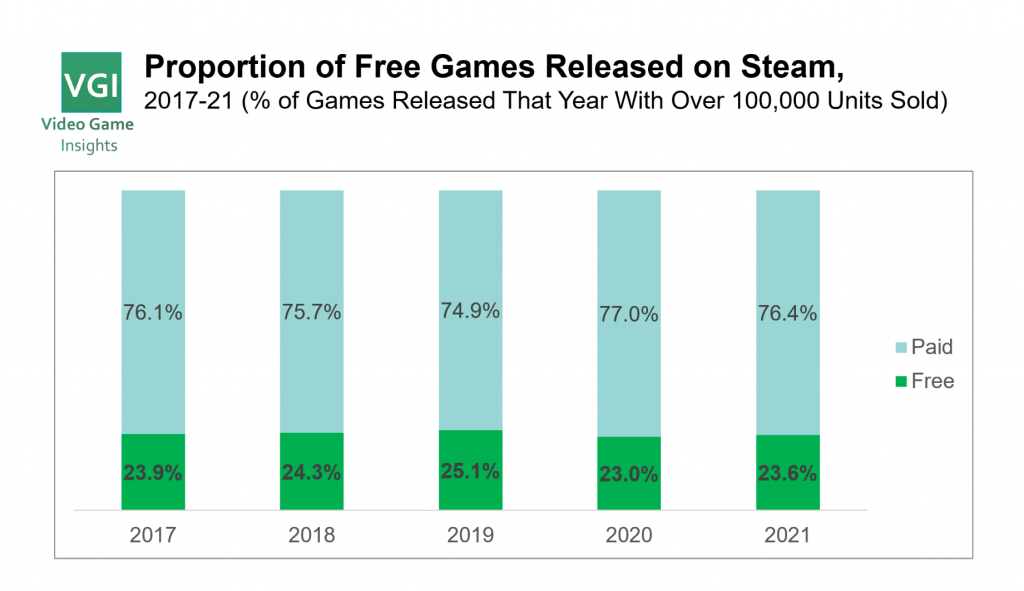

For games that have sold over 100k units, the proportion of free games is higher – c. 23% VS the Steam average of c. 18%. The trend of free games decline is also not evident within this group of games.

This indicates that large studios with live ops capabilities are still finding a lot of value in freemium models, even on PC while smaller developers have got better at charging for their games.

Average prices of games on Steam have increased in 2021

2020 saw an overall decline in the average game price. This was mostly driven by an increase of low price or free hobby games.

2021 on the other hand saw a big increase in the average price of games released. An average game on Steam cost $7.8, more than the $7.3 in 2020.

The shift in pricing was also evident in more expensive game buckets, with 23.4% of games being priced $10 or above, more than ever before. Still, only 5.5% of the games on Steam see a price tag of $20 or more.

Top grossing games are utilising in-app purchases and DLCs

Our friends at Gamediscover.co have released a fantastic article analysing the top grossing games on Steam in 2021.

The main take-away from that is that almost all of the biggest sellers on Steam use IAPs and/or DLCs to boost their revenue.

These games tend to have a longer life, with over half of the top selling games also being top selling in 2019.

Gaming as a service (GaaS) has become an ever important part of large studios. Top titles on mobile are now starting to be over 10 years old (Candy Crush) and it’s interesting to see these longer lifespans also coming to PC and consoles (GTA 5). This will no doubt continue to be a trend of AAA releases.

The games industry has settled into a new normal

It’s clear that there have been structural shifts to the games industry with Covid. The target audience has broadened significantly with more gamers around than ever before.

Trends like social games and working from home may or may not be temporary, but some things have shifted permanently for the games industry.

The games industry’s covid time growth is here to stay. We’re also seeing more indie titles around than ever before. Making games has become easier due to the rise of Unity and other engines. Making games has also become a hobby for more people than ever before.

If you’re an indie developer or have just enjoyed the insights from this report, check out the Video Game Insights platform. A lot of the features and insights are free for everyone!